Frequently Asked Questions

There are two aspects with which to deal:

1. Recording the Sickness Paid on the Sickness / Holiday tab and

2. Record the sick benefit in order to deal with the refund of SSC and Tax deductions.

To record either holiday or Sick absence you must select the Sickness / Holiday tab in the Pay detail and record either the hours or days (your choice - but this must always be the same unit) as either paid or unpaid.

If you wish your employee to suffer no disadvantage this is how to do it:

1. Create a Pay Type something like Sick Pay Adjustment.

2. When the Employee gets their cheque from Social Secuiry you enter this in the Pay section but you must use a quantity of MINUS 1. You will have to use the minus on the numbers pad. This will have the effect of adjusting the amount paid by the amount received from SSC and reducing the Tax and SSC deductions.

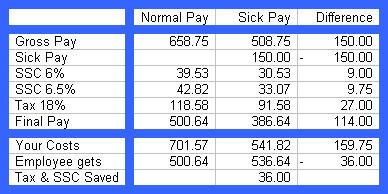

We will take an example where an employee normally gets paid 42.50 hours at a rate of £15.50 per hour. In this case normal pay would be 42.50 x £15.50 = £658.75. SSC would be deducted at 6% and say tax is 18%, the SSC would be £39.53 and the Tax would be £118.58. The resulting Final Pay would be £500.64.

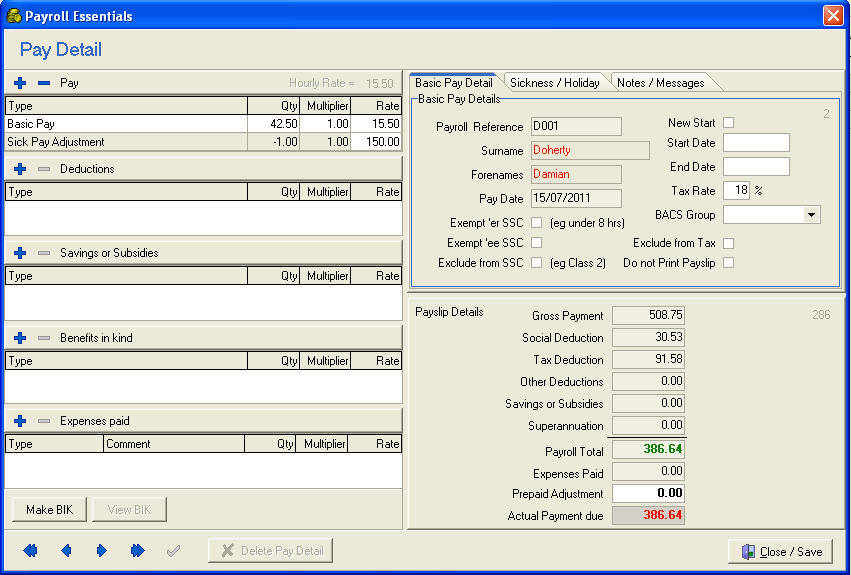

In our example if SSC pay £150 in benefit we complete the pay details as shown below by adding a pay element using the new Pay Type created but remembering to use the minua sign on the numbers pad.

You will see that the overall effect of handling it this way is that the employee gets more money for being off sick. However, this is the effect of refunding the SSC and Tax deducted on the Sickness Benefit element of their pay.

In the grid you can see that the net effect that you pay £186 less which is represented by £150 sick benefit and £36 saved from Tax and SSC. The employee gets £386.64 plus their benefit cheque of £150. This gives them £536.64 which is £36 more due to the Tax and SSC refunding.